Sleep Number: An Interesting Gamble, But Not A Value Play (NASDAQ:SNBR)

DragonImages/iStock via Getty Images

Sleep Number (NASDAQ:SNBR) is an U.S. company specializing in innovative bedding solutions, particularly renowned for its adjustable mattresses. Users can customize the firmness or softness of their mattress according to their individual preferences, utilizing a remote control or a smartphone app to adjust the air pressure within the mattress chambers. Their more premium beds also come with height adjustable head and/or foot sections, as well as temperature control. With a focus on personalized comfort and sleep quality, Sleep Number integrates cutting-edge technology such as sleep tracking features to provide insights into users’ sleep patterns and facilitate optimal rest.

Thesis

While both the U.S. mattress market and Sleep Number have been in decline for the past two years, the industry is projected to return to its historical average annual growth of 4% through the rest of the decade. As consumers’ focus on a healthy sleep increases, Sleep Number is well-positioned to compete with its high-tech adjustable smart beds that come with integrated sleep tracking solutions, allowing users to track their sleeping pattern through the company’s proprietary SleepIQ app.

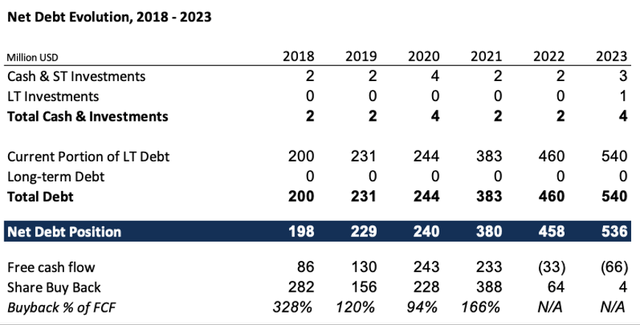

Despite its strong brand and resilient business model, SNBR is currently trading at a significant discount for a reason. Due to disastrous capital allocation decisions, particularly during the 2020-2021 Covid demand boom, the company sits on $540 million of short-term debt, next to $433 million of operating lease liabilities (per December 31, 2023). Meanwhile, Sleep Number was unable to deliver positive free cash flow for two consecutive years (negative $33 million in 2022 and negative $66 million in 2023).

After executing multiple cost cutting initiatives and slashing its 2024 CAPEX budget, management wants to deliver at least $60 million FCF in 2024 to pay down debt. However, consumer demand will remain shaky in the near-term, creating uncertainty on the company’s ability to execute on their plans.

Given its default risk, which I will assess in more details in this article, SNBR is for sure no value investment. However, I am giving the stock a hold rating due to its massive rebound potential if management is able to deliver on its guidance and solidify a path to financial stability. If you are a value investor looking for low-risk, high-reward stocks, stay clear. If you are willing to take on more risk for a possible 2-4x over the next 12-24 months, SNBR may be an interesting gamble for you.

As other authors on Seeking Alpha have recently written about Sleep Number’s business model in great detail, I will keep this section short, focusing on key takeaways only. Then, I will dive into Sleep Number’s financial situation and valuation in the context of a potential risk of default.

Sleep Number’s fundamentally solid business model

The mattress market size in the U.S. is estimated to be around $18.5 billion in 2024. Mordor Intelligence projects a 4% CAGR from 2024 to 2029, implying a market size of $22.5 billion by 2029. This is roughly in line with the historical average industry growth rate.

Within the broader market, customized mattresses are expected to see the fastest growth, as consumers are more and more aware of the importance of good sleep for their health. Sleep Number could continue to benefit from this trend, as the company has established itself as an innovation driver in adjustable smart beds, with over 800 sleep-related patents in its portfolio. That is 10x the number of patents of either of its closest competitors, according to the company.

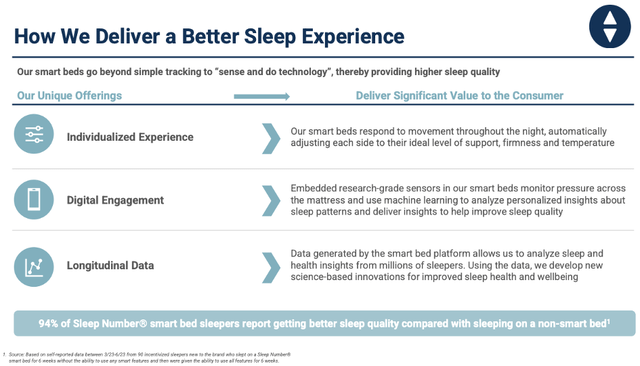

The following chart summarizes Sleep Number’s core value proposition, combining high-tech smart beds with a digital service (insights to improve sleep quality) based on tons of data. The fact that 94% of “smart bed sleepers” report to get better sleep compared to sleeping in a regular bed speaks for itself.

Source: Sleep Number Investor Presentation (March 2024)

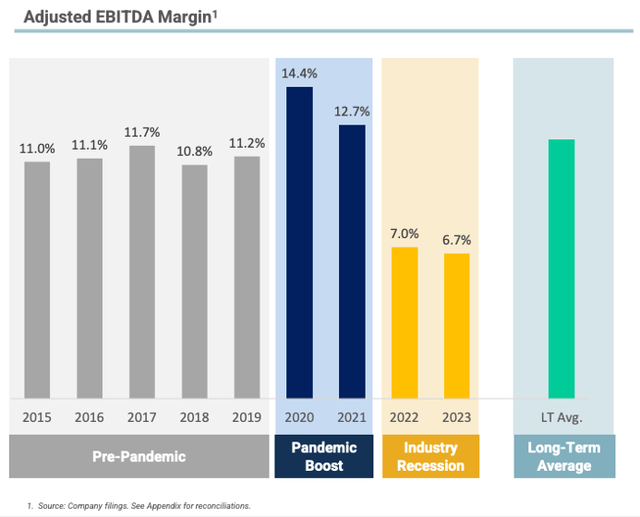

While growing faster than the industry historically (8% CAGR 2014-2029, then almost flat from 2020-2023), Sleep Number has maintained adjusted EBITDA margins around 11% throughout the pre-pandemic period, followed by a pandemic boost (13-14%), and a period of industry recession (7%). The crunch came as gross margins contracted as a result of significant inflation of material and shipping costs, while operational expenses were not immediately scaled back in line with the revenue decline. Meanwhile, management has taken decisive actions to reduce cost and improve margins towards historical levels.

Source: Sleep Number Investor Presentation (March 2024)

For more details, I refer you to the recently published investor presentation, in which management makes even bolder projections for the long-term (see slide 25). I will share my own (more conservative projections) later in the valuation section.

The key takeaway here is that Sleep Number’s business model is intact. While the company has been suffering through an industry-wide revenue decline and margin compression recently, there are no business-related reason to assume that the company won’t rebound when industry growth resumes. Actually, consumer trends and technological leadership both position the company to potentially outgrow the industry over the rest of the decade.

The only reason Sleep Number might be in trouble is if it is unable to fund operations long enough to get out at the other end of the tunnel. But before going there, let’s take a step back and learn about the self-inflicted capital allocation mistakes that got Sleep Number in this difficult situation in the first place.

How disastrous capital allocation led to shareholder value destruction

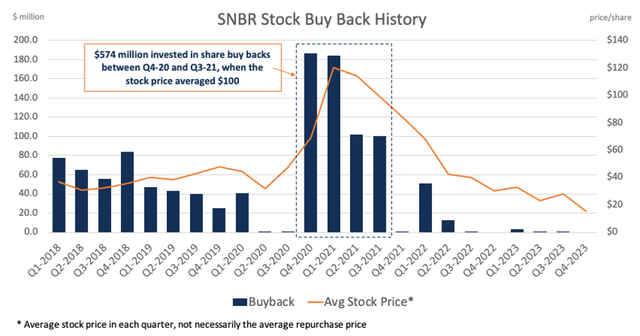

Now let’s get into the ugly part, which in my opinion has caused SNBR to fall well below the market capitalization it would have had right now, had it made different capital allocation choices during the 2020/2021 Covid boost. In fact, Sleep Number is a text book example of how shareholder value can be permanently destroyed by the inappropriate use of share buyback programs. The following chart illustrates the company’s buyback history since 2018.

Source: Stock Research Platform

As Warren Buffet put it, “the math isn’t complicated”. When companies buy back stock below intrinsic value, remaining shareholders gain. When companies pay too much, they destroy shareholder value. Obviously, the intrinsic value of a company is not a static figure. Back in 2020-2021, when Sleep Number’s FCF jumped to $230-240 million per year, about 2.5x times the previous years’ average, SNBR’s market cap jumped to $3.5 billion, compared to the $1-$1.5 billion the company had been trading for most of the time since 2011.

What is regrettable is to see that Sleep Number’s management chose to repurchase stock for a total of $574 million throughout this price rally (Q4 2020 to Q3 2021), which is more than they had spent on buybacks in the 3 years prior. While we need to be careful not calling out a mistake with the benefit of hindsight, I cannot find any good rationale for increasing buybacks so substantially at the time. One would have had to believe that the Covid induced demand explosion would continue or even accelerate for the stock to be undervalued at over $100.

There is only one thing that is worse than burning your own cash: it is to burn borrowed money. Don’t get me wrong. Taking on debt to buy back your stock is not inherently irrational. It is always a high-risk strategy, but it can make sense when the cost of borrowing is low and your stock price trades significantly below its intrinsic value. While this may have been the case when Sleep Number started this practice back in 2017/2018, it certainly was no longer the case when the stock price started soaring.

This is when responsible capital allocation would have mandated to either retire some of the debt or at least start building up cash reserves. Instead, Sleep Number kept on buying back more stock than it generated FCF, yet increasing its debt level, while literally keeping no cash on the sidelines.

Source: Stock Research Platform

David Callen, the CFO who had overseen the transition of Sleep Number from being a mattress retailer to becoming a sleep wellness technology company since 2014, announced his exit in January 2023. Sleep Number states that “his departure is not the result of disagreements with the company on any subject, including its operations, policies or practices“, leaving the motives for his decision to anyone’s interpretation.

After a few months of interim management by Chris Krusmark, Sleep Number’s Chief Human Resources Officer, the company appointed Francis Lee to the CFO job. Mr. Lee joined Sleep Number from Wyze Labs Inc., a privately owned company in the smart home camera business. Before that, he held various senior finance positions at Nike (NKE). Based on his publicly available CV, I do not think that Mr. Lee has yet had to lead a turnaround involving a highly leveraged balance sheet. Yet, this is precisely what he signed up for at Sleep Number.

Let’s take a closer look at Sleep Number’s financial situation to assess the actual risk of default.

Assessing Sleep Number’s risk of default

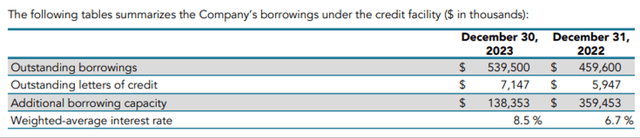

To start with, let’s take a look at Sleep Number’s current borrowings, which pertain to the company’s $685 million credit facility according to note (6) in Sleep Number’s 2023 10-K form. You will note that both the borrowings and the interest rate went up since the end of 2022, which is the consequence of negative free cash flows and renegotiated credit covenants during last twelve months, respectively.

Sleep Number Outstanding Borrowings (Source: Sleep Number 10K 2023)

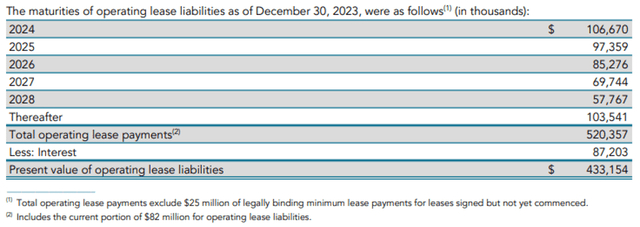

In addition, Sleep Number also has $433 million in net lease obligations related to its stores, but also headquarters and manufacturing & distribution facilities.

Sleep Number Operating Lease Liabilities (Source: Sleep Number 10K 2023)

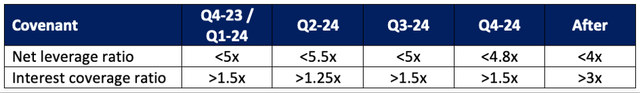

A default would technically occur if Sleep Number becomes unable to pay back either its debt, lease or interest obligations, also implying it is unable to refinance through new debt. The current credit agreement requires the company to “comply with, among other things, a maximum net leverage ratio and a minimum interest coverage ratio“. This means that if at any point in time Sleep Number is unable to meet these requirements, it either has to renegotiate the credit agreement, or the lenders may request a repayment in part or in full due to a breach in the credit covenants.

In practice, the latter almost inevitably leads to a bankruptcy filing, and therefore rarely happens unless there is no way out, as lenders also lose money in the process. More frequently, credit covenants will be renegotiated amongst the parties to accommodate “temporary challenges” in the business. This gives the company time to recover, and the lender usually requests a higher interest to account for the elevated risk. This is exactly what happened now already several times for Sleep Number.

Specifically, Sleep Number calls out 3 amendments to the credit agreement in its 10K:

- October 26, 2022, when the previous net leverage ratio ceiling of 3.75x was temporarily suspended for the first time, allowing up to 5x until the 2nd quarter of 2023, and increasing interest rates accordingly;

- July 24, 2023, when the permissible 5x net leverage ratio was extended by one more quarter, followed by a 4.5x ceiling for the 4th quarter of 2023 and onwards;

- November 2, 2023, when the most comprehensive set of changes were made, including a reduction of the aggregate commitment by the lenders to $685 million (from previously $825 million), changes in how net leverage is calculated (to include operating lease liabilities), a further extension of a higher permissible net leverage ratio (up to 5.5x) and a lower interest coverage ratio (min. of 1.25x) for Q2-2024, and of course, a corresponding hike in interest rates.

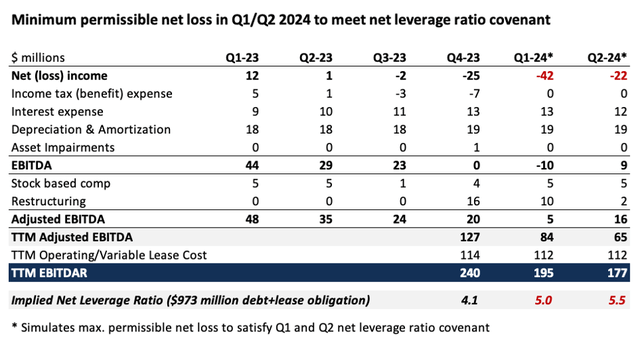

The following table summarizes the current covenants by quarter based on the latest amendment:

Sleep Number Debt Covenants (Source: Sleep Number 10K 2023)

So, what does this all mean? Well, a few things, in my opinion. First, Sleep Number still expects trouble to continue in the first half of 2024, with peak leverage reached by Q2 (this aligns with what they stated during the earnings call). Second, both Sleep Number and the banks believe that things will start improving in the second half of the year, which is why banks are willing to continue extending covenant “exceptions” in exchange for higher interest payments. Conveniently, they are lowering the required interest coverage ratio at the same time, to make sure Sleep Number can “afford” the higher interest (at least on paper).

The question is how long this game can be played. In my experience, it will be played as long as needed, provided Sleep Number can consistently show improvement in its financial performance. The key factor is the company’s ability to return to sustainable, positive free cash flow generation, which means that Sleep Number cannot only service its interest obligations, but also generate enough cash to fund its business needs and start paying down debt. In other words, if management can deliver $60-80 million FCF in 2024 as per their guidance, this would be an immense step towards regaining control of their financial health… and a strong catalyst for the stock.

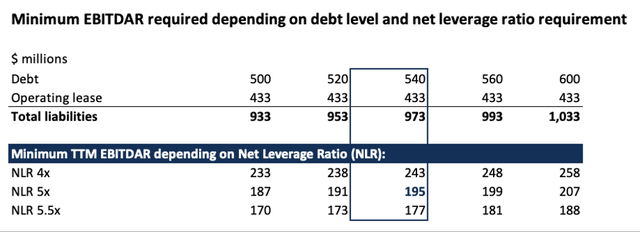

On the flip side, what if Sleep Number misses their guidance? Let’s do some math to determine what “margin of safety” the above covenants provide. At the end of Q4-2023, Sleep number reported a net leverage ratio of 4.1x EBITDAR. Based on borrowings of $540 million and net operating lease liabilities of $433 million, this implies EBITDAR was about $240 million in 2023. While I could not find the formal definition of EBITDAR per the credit agreement, this number reconciles to the sum of Sleep Numbers 2023 adjusted EBITDA of $126 million and the 2023 operating leases costs of $114 million.

Source: Stock Research Platform

Based on the above table, we can see that at its current debt level, Sleep Number can afford EBITDAR to drop to $195 million on a TTM basis in Q1 & Q3 2024 (5x NLR), or even to $177 million in Q2 (5.5x NLR), based on agreed covenants. While this may seem like a solid margin of safety away from the 2023 EBITDAR of $240 million (19% and 26% below, respectively), it suddenly looks more threatening when you consider the quarterly EBITDA phasing within 2023.

As you can see from the table below, if performance trends to continue to deteriorate into 2024, EBITDAR could come dangerously close to covenant requirements again. This is due to the fact that EBITDA sequentially dropped each quarter throughout 2023. The net loss figures in red represent the maximum “permissible” loss in the respective quarters to stay within the covenant requirements, assuming my other measures to get to EBITDA are directionally correct.

Admittedly, the $42 million “permissible” loss that could lead to a 5x net leverage ratio in Q1-2024 would require quite a disastrous quarter. To be noted: the permissible loss would be reduced in case Sleep Number has to tap further into its credit line to fund operations.

Source: Stock Research Platform

So, what if poor performance does continue as a result of a slower than expected recovery in the macro-environment? Well, most probably we would see yet another amendment to the credit agreement, maybe granting a 5.5x ceiling throughout the year. I personally believe it would take more than sluggish demand to throw lenders off to the point they would cut their losses.

But clearly, it is not a comfortable situation by any stretch, and Sleep Number is very much at risk of default if any material event were to happen (think of a broader economic crisis materially impacting demand beyond current expectations, or think of a major safety/quality concern with one of its flagship smart beds causing sales to tumble). Those are not extremely likely scenarios, but one needs to be able to sleep well with such risks in order to buy Sleep Number now.

Sleep Number’s fair value

Determining SNBR’s fair value is tricky: to start with, the last few years have highlighted how volatile Sleep Number’s business can be, which could result in a broad range of business outcomes over time. The other challenge is to account for the risk of going out of business, which as we just saw is still not negligible at this point in time.

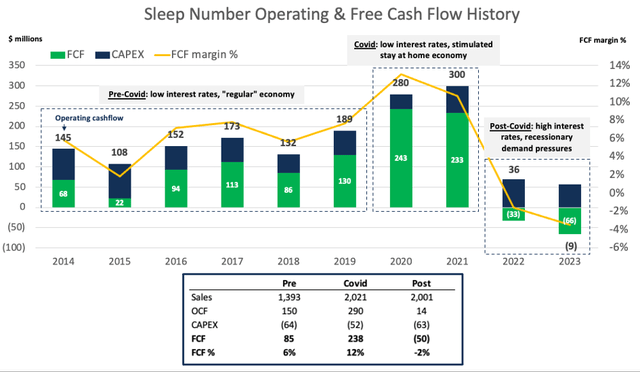

Let’s first address the matter of projecting FCF. For that, it is helpful to take a look at Sleep Numbers long-term history. Below chart shows operating cashflows since 2014, broken down between capital expenses in blue and free cash flows in green.

Source: Stock Research Platform

We will all agree that the Covid period 2020-2021 presented unique tailwinds for Sleep Number, as people had excess cash, could borrow at no cost, and were locked in their homes. That is three tailwinds at once for a premium bedding provider, which propelled FCF in the $230-240 million range (a 12% FCF margin). But equally, the post-Covid period 2022-2023 was marked by unique recessionary industry headwinds, as people started spending their remaining excess cash on travel and services after the re-opening, while the cost of borrowing went through the roof in a matter of months. As a result, FCF crashed to a negative $33 million in 2022 and negative $66 million in 2023.

Looking out to the next 5-10 years, costs of borrowing are likely to come down, while consumer spending habits will reverse to the mean. Sleep Number’s historical average FCF margin was 6% from 2014 to 2019 (pre-Covid). I believe that it is reasonable to expect free cash flow margins to revert in this direction mid-term, as Sleep Number is actively working to cut operational expenses, interest expenses will come down, and demand will rebound.

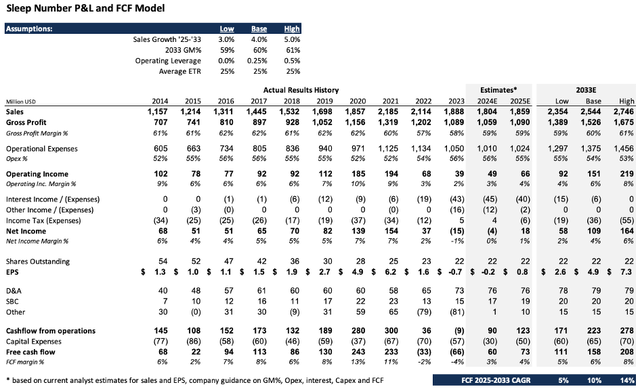

Below you will find a high-level financial model aligned with current analyst sales & EPS estimates and company guidance for 2024E and 2025E. For the subsequent period 2025-2033, I am modeling 3 scenarios assuming different levels of revenue growth, gross margin, and operating leverage (i.e., by how much operating expenses will grow less than revenue). I refer you to the Q4 earnings call which contains a lot of details on 2024 guidance.

Source: Stock Research Platform

The key takeaway is that despite continued revenue headwinds, management expects to be able to keep improving gross margins as material cost pressures recede, while executing on year 2 of their $125+ million Opex saving initiative vs. 2022. This should lead to continued positive operating income, while net income is still expected to remain negative as interest expenses remain high ($45 million) and as the company will need to take another restructuring charge ($12 million) to execute on cost savings. That said, as working capital stops being a cash burn and management slashed Capex in half from $60 to $30 million, Sleep Number expects to generate at least $60 million of free cash flow that it will dedicate to retire short-term debt. Revenue growth is expected to resume in 2025 onwards.

As always, I am intentionally conservative with my forward-looking assumptions. Despite a historical revenue CAGR of 8% from 2014-2019, I am assuming sales growth between 3% and 5% from 2025-2033. For gross margins, I am assuming 59-61%, vs. a historical 61-62% pre-Covid. Finally, I am assuming moderate operating profitability leverage in the base and high case, with Opex growth 25bps to 50bps slower than revenue.

As a result of the above assumptions, I end up with a FCF of $158 million by 2033 in the base case (range of $111 million to $208 million). This seems plausible relative to a FCF of $130 million in 2019, and (appropriately?) conservative relative to management’s $200+ million projection (my high case). The implied FCF CAGR of 10% between 2025 and 2033 in the base case, with a range 5% to 14%.

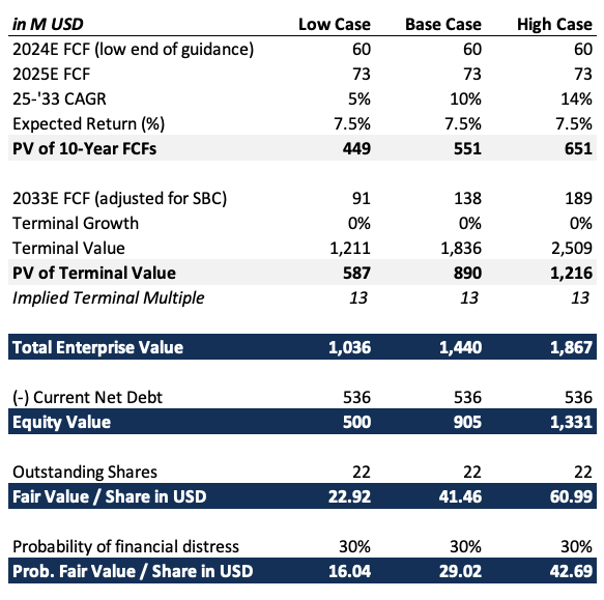

With these projections in mind, we can calculate the stock’s fair value in each scenario. For that, I am adjusting the free cash flows for stock-based compensation, and applying a WACC of 7.5% in line with the company’s current capital structure (note I am using the book value of debt as proxy for the market value of debt). I am assuming flat terminal growth as I find it hard to be more optimistic on a mattress company, regardless of current brand strength.

This leads to a fair value per share of over $41, with a broad range of $23 to $61. However, that reflects the value of the business if it does not fail on its debt. Despite so far successful renegotiations with the banks, Sleep Number remains dangerously close to its covenants, leaving no room for any material adverse event.

For what it is worth, and I don’t want to make this more scientific than it is, Macroaxis rates Sleep Number’s likelihood of distress to be under 35% at the time of publishing this article. Given it would take a material negative event to get SNBR in trouble, I would directionally concur with this assessment. To bring this risk into the valuation, I am assuming a 30% chance of the stock going to $0 as a result of bankruptcy. The risk-adjusted fair value for SNBR is thus $29, with a range of $16 to $43. This means that the stock is currently trading at the low end of its (risk-adjusted) fair value range.

Sleep Number Fair Value Scenarios (Source: Stock Research Platform)

Conclusion

On the Stock Research Platform, I am looking for asymmetric low risk, high reward opportunities. Given its strong brand and fundamentally solid business model, Sleep Number could be a multi-bagger from the currently depressed price levels if it survives the economic downturn. However, its elevated debt level and recently negative FCF make SNBR a high-risk investment, and thus a no-go for value investors.

This does not mean that SNBR is not worth a gamble, depending on your investment style and personal risk profile. I personally placed a bet on the company’s recovery in my private “trading portfolio”, and I may continue to sell puts if and when the stock price slumps back to the lower $10s (provided no materially new information). However, I will limit the total position size to max. 2% of my investment capital, and I would never add the stock to my long-term “value portfolio”.

Overall, I give SNBR a hold rating. I would neither short the stock due to its massive (and more likely than not) recovery potential, nor would I add it to a value portfolio due to its non-negligible risk of getting into serious financial trouble.

link